About

About

Lendexa Mortgage

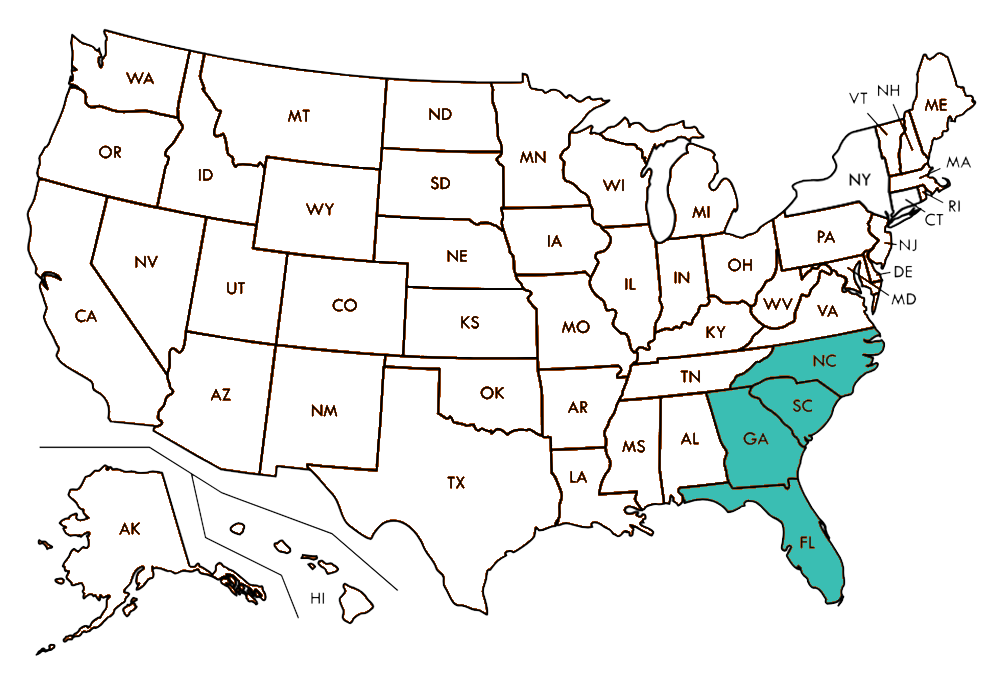

Buying a home or refinancing shouldn’t feel complicated. It should feel clear. Lendexa Mortgage is a Charlotte-based mortgage broker serving North Carolina, South Carolina, Florida, and Georgia. We are focused on transparency, sound judgment, and calm decision-making from the start. Our goal is to provide transparency before commitment, real guidance before pressure, and professional review when the decision actually matters.

What Makes Us Different?

We don’t push rates, rush decisions, or force you into one-size fits all answers. Lendexa Mortgage is built around judgement, not volume. As an independent mortgage broker, we evaluate your full picture, explain tradeoffs clearly, and help you make decisions that hold up under pressure- not just on paper. Our role is to reduce uncertainty, protect your downside, and guide the process calmly from the first conversation to closing.

Independent by design

As a broker, we're not tied to one lender- we choose what fits the situation.

-

Clear decisions early

we focus on getting the structure righ up front so there are fewer surprises later. -

Judgement over automation

Tools inform the process- they don't replace experience or critical thinking -

Calm, controlled execution

We manage complexity internally so clients experience clarity and stability -

Human judgement at every decision point

Every file is reviewed, questioned, and pressure-tested, not blindly routed through a system -

Built for real scenarios

From straightforward purchases to layered, high-stakes files- we're comfortable where others hesitate -

Speed without shortcuts

Efficient processes matter, but never at the expense of accuracy or durability -

Real options, clearly explained

You'll see tradeoffs, not sales pressure or half answers -

Independent by design

As a broker, we're not tied to one lender- we choose what fits the situation -

Guidance that holds up

Our goal isn't approval alone- it's decisions that still make sense at closing -

Efficient by design

Streamlined workflows that protect accuracy from start to finish -

Systems that scale trust

Consistency isn't accidental- its designed -

Professional accountability

If something changes, you hear it early and directly

Guidance that holds up

Our goal isn't approval alone- it's decisions that still make sense at closing.

Explore Your Options

Use our website to view live custom interest rates and sign up for rate notifications to monitor the market. /

Pre-Approval

Apply online or speak with a loan officer to get pre-approved quickly and easily.

Tailored Loan Solutions

Work with us to select the loan product that best fits your needs and goals.

Close with Confidence

Enjoy a streamlined closing process, backed by our commitment to speed and transparency.

How It Works

1. Explore: Check out live rates and sign up for alerts.

2. Pre-Approval: Apply online or speak with us directly to start pre-approval.

3. Choose Your Loan: We compare offers and help you select the right one.

4. Close with Confidence: Enjoy a smooth, transparent closing process.

Everything is designed to maximize your confidence and minimize uncertainty.

Credentials & Compliance

We operate under Loan Factory (NMLS ID: 320841) and are licensed in:

North Carolina (License #: B‑194058)

South Carolina (License #: 320841)

Georgia (Broker/Processor License #: 42425, NMLS: 1999850)

Florida (Lender License #: MLD2334) (lendexamortgage.com)

Meet Our Team & Client Satisfaction

Our expert loan officers—including Vincent Carrieri, Andy Grimes, and more—are dedicated to guiding you personally through the process (lendexamortgage.com). We’re proud to have earned a 4.98★ rating from over 80 verified reviews, a testament to the satisfaction our clients experience (lendexamortgage.com).

Let’s Begin

Ready to experience a smarter mortgage journey?

- View live rates

- Get a personalized quote

- Sign up for our rate alerts

- Contact a Loan Expert

We’re excited to partner with you and make your homeownership or refinance dreams come true.

Clients

Come First

We make sure our clients get the best support from our staff. We will walk you through the whole mortgage process and ensure your transactions close smoothly.

We offer superior loans and mortgages.

Lendexa Mortgage LLC works with multiple lenders. We can provide our clients with extremely competitive pricing. Now you can do all your comparison shopping with one company without wasting time with several banks or brokers.

State Licenses

State Licenses

State Licenses

Navigating the details of state licenses can be complex. To simplify this, we’ve outlined our licensing information and what it means for you, ensuring you have a clear understanding of our credentials and compliance.

FLORIDA

GEORGIA

NORTH CAROLINA

SOUTH CAROLINA – DCA

Loan Experts

MEET OUR TEAM

Finding the right support for buying a home or refinancing a mortgage is essential. To help you get acquainted with the people who will guide you through the process, we’ve introduced our dedicated team members and their expertise.

No posts found!

No posts found!

No posts found!

No posts found!

No posts found!

No Posts Found!

F. A. Q's

Common Questions

Common Questions

Good decisions start with good questions. Here are answers to the ones we hear most often.

Yes. Many of the homebuyers we work with start well before they’re ready to apply for a mortgage or begin house hunting. Early conversations focus on understanding what’s realistic, how credit, income, savings, and timing affect future loan options — without pressure to move forward before you’re ready.

For more information, check out our Commonly Asked Questions.

Communication is structured, proactive, and clear. You’ll know where your loan stands, what happens next, and when decisions or documents are needed. We provide updates at meaningful milestones and address issues directly so you’re never left wondering about status or next steps.

For more information, check out our Commonly Asked Questions.